1. Spending > Earning

During your working life, you’ve been in the habit of earning and saving money. Retirement is the time when you switch from saving to spending, as you use your retirement savings to cover your living expenses. However, the tax implications of retirement are entirely different, and unexpected post-retirement taxes can catch you off guard, cutting into your retirement savings and diminishing your quality of life.

One of the main challenges faced by retirees is managing their expenses within the limits of their retirement income. This can be especially difficult when unexpected post-retirement taxes arise. These taxes can come in many forms, such as property taxes, capital gains taxes, and estate taxes. They can be costly and difficult to predict, making it challenging to plan your retirement finances effectively.

For example, if you plan to downsize your home in retirement and move to a smaller property, you may be faced with unexpected property taxes. These taxes can vary widely depending on where you live and the value of your property. If you’re not prepared for these taxes, they can take a significant chunk out of your retirement savings, leaving you with less money to cover your living expenses.

Moreover, post-retirement taxes can also cut into your investment income. For example, if you’re relying on investment income to supplement your retirement income, capital gains taxes can eat into your returns and reduce your disposable income. This can make it challenging to cover your living expenses and enjoy the retirement lifestyle you desire.

In conclusion, managing your retirement finances requires careful planning and preparation.

Unexpected post-retirement taxes can catch you off guard and cut into your retirement savings, making it challenging to maintain a high quality of life in retirement. By understanding the tax implications of retirement and planning your finances carefully, you can minimize your tax liability and maximize your retirement income, ensuring that you have enough savings to live comfortably and enjoy your retirement years to the fullest.

2. Longer Average Lifespan

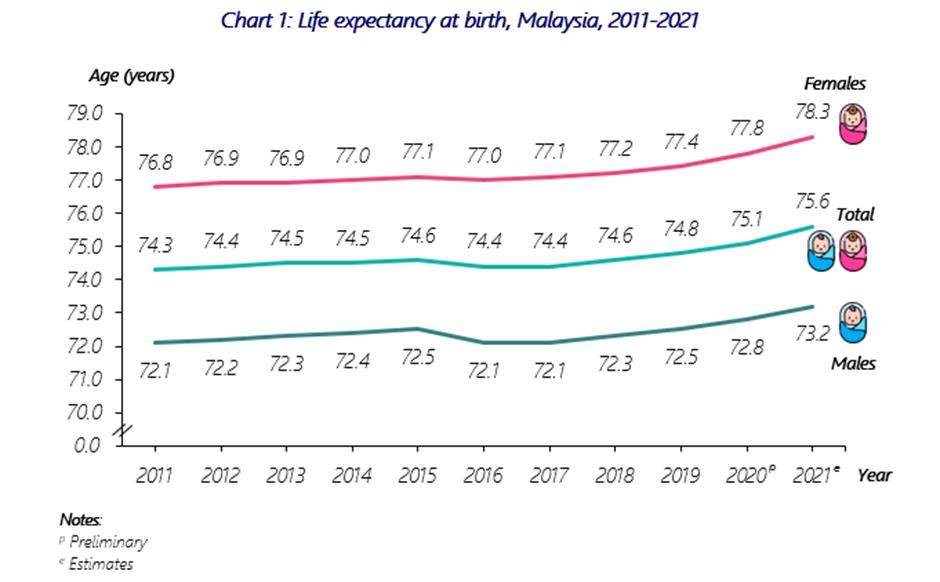

Our statistics show that the average lifespan for Malaysians is about 76. When the retirement savings system was set up in the 1950s, the average lifespan was about 55. That’s why the government raised the retirement age from 55 to 60 to allow people to work longer and save more.

The longer average lifespan of Malaysians is a significant factor in the importance of tax planning for retirement. With people living longer, it means that their retirement savings have to stretch further, which may not have been a concern when the retirement system was first established. Therefore, it is essential to have a retirement plan that takes into account the possibility of living longer than expected.

Having a longer lifespan also means that healthcare costs can be higher. Medical expenses can be a significant financial burden for retirees, especially if they have chronic health conditions or require long-term care. Tax planning can help retirees to manage their healthcare costs by taking advantage of tax deductions for medical expenses and ensuring that their retirement savings are sufficient to cover any potential medical costs.

Moreover, with a longer lifespan, there may be a greater likelihood of needing long-term care, which can be costly. Tax planning can help individuals to plan for such situations by investing in long-term care insurance or by setting aside funds specifically for this purpose.

Another factor to consider is that many people are choosing to retire earlier, often in their 50s or even earlier. With a longer lifespan, this means that individuals may have a more extended retirement period to finance, making it even more critical to plan ahead for their finances. By having a sound tax planning strategy, individuals can ensure that they have enough retirement savings to last throughout their extended retirement years.

In conclusion, the longer average lifespan of Malaysians highlights the need for proper tax planning for retirement. By taking into account potential medical costs, long-term care, and a more extended retirement period, individuals can ensure that they have enough savings to live comfortably throughout their retirement years.

3. Maintain High-Quality Life

:max_bytes(150000):strip_icc()/168831470_HighRes-56a904d85f9b58b7d0f75bad.jpg)

According to the Employees Provident Fund (EPF), you will need to save at least RM240,000 by the time you retire at 55 years old to cover basic needs such as food and everyday costs. Soberly, it also said this year that 73% of its members would not be able to meet this requirement. If you retire with RM240,000, you will have RM1,000 monthly to live on. It may be enough for essential expenditure, but more is needed if you would like to enjoy a good retirement.

Tax planning for retirement is crucial to maintaining a high-quality life in retirement. As the EPF has highlighted, many Malaysians are not saving enough to cover basic expenses during retirement. Without proper tax planning, it can be challenging to accumulate enough savings to enjoy a good retirement.

A sound tax planning strategy can help retirees to maximize their retirement savings, reduce their tax burden, and make their money last longer. By taking advantage of tax-advantaged savings accounts, such as EPF, 401(k)s, and IRAs, individuals can reduce their taxable income while increasing their retirement savings. This can help them to build a more significant nest egg to support their desired lifestyle in retirement.

Moreover, proper tax planning can also help retirees to minimize their tax burden, leaving them with more money to spend on things that matter to them. By understanding the tax implications of different income sources, retirees can plan their withdrawals and distributions to minimize their tax liability. For example, retirees can use a mix of taxable and tax-free accounts to optimize their income and minimize their tax burden.

Furthermore, tax planning can help retirees to manage their finances more effectively by ensuring that they have enough savings to maintain their desired lifestyle. By taking into account potential expenses, such as healthcare costs, long-term care, and travel, individuals can create a comprehensive retirement plan that includes tax planning to ensure that their retirement savings last as long as they need them to.

In conclusion, tax planning is essential for maintaining a high-quality life in retirement. It can help retirees to maximize their savings, minimize their tax burden, and manage their finances more effectively. With a sound tax planning strategy, retirees can ensure that they have enough savings to enjoy the retirement lifestyle they desire.

4. Maximization of Tax Deductions

Maximizing tax deductions is an important part of tax planning for retirement. Tax deductions reduce your taxable income, which can help you to save on taxes and increase your disposable income. By taking advantage of available tax reliefs, you can save more taxes and have more money available to fund your retirement.

One example of how tax planning can maximize tax deductions is through separate assessments for a married couple. Under Malaysian tax laws, a married couple can choose to assess their income separately. This can help to reduce their tax liability and allow them to enjoy more personal relief than if they were to opt for a joint evaluation. You may refer to Personal Tax Reliefs in Malaysia to discover more tax relief.

Additionally, there are many other personal tax reliefs available that can help to reduce your tax liability and increase your disposable income. For example, tax reliefs are available for education expenses, medical expenses, and donations to charitable organizations. By understanding these tax reliefs and planning your retirement finances accordingly, you can maximize your tax deductions and save more money for your retirement.

Moreover, tax planning can help to minimize taxes on your retirement savings. With a proper tax planning strategy, you can make withdrawals from your retirement accounts in a tax-efficient manner, minimizing your tax liability and maximizing your retirement savings. By understanding the tax implications of different types of retirement accounts and investment vehicles, you can create a comprehensive retirement plan that takes advantage of all available tax deductions.

In conclusion, maximizing tax deductions is an important part of tax planning for retirement. By taking advantage of available tax reliefs, planning your finances carefully, and understanding the tax implications of different investment vehicles, you can minimize your tax liability and maximize your disposable income in retirement. With a sound tax planning strategy, you can ensure that you have enough savings to live comfortably and enjoy the retirement lifestyle you desire.

A Pillar of Strength in Golden Years: 10 Paths on How Regular Screenings Uphold Your Health

In the evocative voyage of life, the golden years emerge as a time to relish the fruits of decades of labor, to bask in the

Unlock the Secret to Sweet Dreams: 10 Ways of Enhancing Sleep Quality as You Age

Share on facebook Facebook Share on twitter Twitter Share on linkedin LinkedIn Share on pinterest Pinterest Share on telegram Telegram Share on whatsapp WhatsApp Share

Building Bridges, Not Walls: 10 Methods of Mastering the Art of Cultivating Social Connections in the Golden Years

Share on facebook Facebook Share on twitter Twitter Share on linkedin LinkedIn Share on telegram Telegram Share on whatsapp WhatsApp Share on email Email Share

Navigating the Golden Years: 10 Ways to Achieve Emotional Wellness and Conquering Loneliness

Share on facebook Facebook Share on twitter Twitter Share on linkedin LinkedIn Share on pinterest Pinterest Share on telegram Telegram Share on whatsapp WhatsApp Share

Stay Brainy in Your Golden Years: 10 Fun Activities to Keep Your Mind Sharp and Engaged!

Hello, brain buffs! Aging might be inevitable, but letting our minds turn to mush? No way, José! Time to boot up those brain cells and

10 Effective Exercise Routines for Older Adults: Low-Impact Fitness Options

Of course, maintaining physical health is crucial at any age, but especially so as we grow older. Here are ten gentle, effective, and friendly exercise