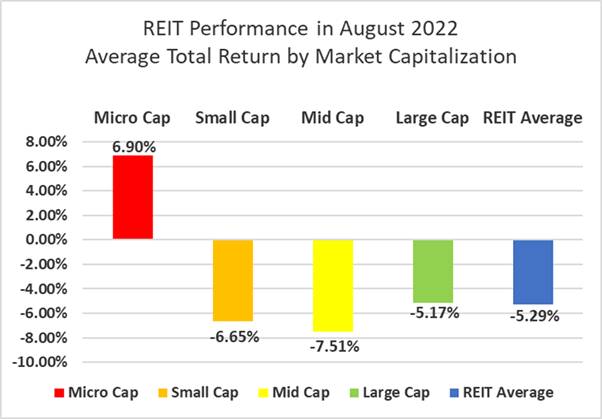

- The REIT sector has declined in 6 of the first 8 months of 2022, including a -5.29% total return in August.

- Only 15.06% of REIT securities had a positive total return in August.

Real Estate Investment Trusts (REITs) are a popular investment vehicle for many investors. REITs are companies that own, operate, or finance real estate properties. They allow investors to invest in real estate without having to purchase a physical property. While REITs can be a great way to diversify an investment portfolio, they do come with some downsides that investors should be aware of.

Interest Rate Risk

REITs are often viewed as an alternative to bonds because of their dividend yield, which is typically higher than bonds. However, REITs are sensitive to interest rate changes. When interest rates rise, the value of REITs tends to decline. This is because investors can earn a higher return on bonds, which reduces the attractiveness of REITs. Conversely, when interest rates fall, REITs tend to perform well because they become more attractive to investors seeking higher returns.

Market Risk

Like all investments, REITs are subject to market risk. REITs are traded on the stock market, so their value can fluctuate based on market conditions. When the stock market experiences a downturn, REITs tend to decline in value. In addition, REITs are vulnerable to industry-specific risks, such as changes in government regulations or economic conditions that affect the real estate market.

Lack of Control

When investing in a physical property, the investor has control over the property and its management. With REITs, the investor has no control over the properties owned by the REIT. The management of the REIT is responsible for the operation and management of the properties. This lack of control can be a disadvantage for investors who want to have more say in how their investments are managed.

Taxation

REITs are required by law to distribute at least 90% of their taxable income to shareholders in the form of dividends. While this may seem like a benefit to investors, it also means that REIT dividends are subject to ordinary income tax rates. This can be a disadvantage for investors who are in higher tax brackets.

Fees

Like all investments, REITs come with fees. The fees associated with REITs can be higher than other investments, such as index funds or mutual funds. These fees can reduce the overall return on investment, which is a disadvantage for investors.

Limited Growth Potential

REITs are required by law to distribute at least 90% of their taxable income to shareholders in the form of dividends. This means that REITs have limited growth potential compared to other types of investments. Instead of reinvesting profits back into the company, REITs must distribute their profits to shareholders. This can limit the ability of the company to grow and expand.

Concentrated Investments

Many REITs focus on a specific sector of the real estate market, such as retail, residential, or office space. This means that investors who invest in REITs are making a concentrated investment in a specific sector of the real estate market. If that sector experiences a downturn, the value of the REIT will decline. This can be a disadvantage for investors who want to diversify their investments across different sectors of the economy.

Inflation Risk

REITs are often viewed as an inflation hedge because they tend to perform well during periods of inflation. However, REITs are not immune to inflation risk. Inflation can drive up the cost of construction, which can reduce the profitability of new projects. In addition, inflation can cause interest rates to rise, which can reduce the attractiveness of REITs to investors seeking higher returns.

In conclusion, while REITs can be a great way to diversify an investment portfolio, they do come with some downsides that investors should aware of. These downsides include interest rate risk, market risk, lack of control, taxation, fees, limited growth potential, concentrated investments, and inflation risk. It is important for investors to carefully consider these risks before investing in REITs.

Investors who are considering investing in REITs should also keep in mind that not all REITs are created equal. Some REITs may be more susceptible to certain risks than others, depending on their specific focus and strategy. It is important for investors to conduct thorough research before investing in any REIT to ensure that it aligns with their investment goals and risk tolerance.

Despite the downsides of investing in REITs, they can still be a valuable addition to a diversified investment portfolio. REITs can provide investors with exposure to the real estate market without the hassle and expense of owning physical property. In addition, the dividend yield offered by REITs can be attractive to investors seeking regular income from their investments.

Investors who are interested in investing in REITs should consider working with a financial advisor to help them navigate the risks and benefits of this type of investment. A financial advisor can help investors identify high-quality REITs, assess their risk tolerance, and develop a well-diversified investment portfolio that includes REITs as a component.

In summary, while there are downsides to investing in REITs, they can still be a valuable addition to a diversified investment portfolio. Investors should carefully consider the risks associated with REITs and conduct thorough research before investing in any specific REIT. With the help of a financial advisor, investors can build a well-diversified portfolio that includes REITs and other types of investments to help them achieve their long-term financial goals.

References

https://seekingalpha.com/article/4542048-the-state-of-reits-september-2022-edition

Gut Health for Yoginis: Enhancing Your Practice with Fiber and Ancestral Nutritions Fibre Clenz

Share on facebook Facebook Share on twitter Twitter Share on linkedin LinkedIn Share on facebook Facebook Share on pinterest Pinterest Share on telegram Telegram Share

A Pillar of Strength in Golden Years: 10 Paths on How Regular Screenings Uphold Your Health

In the evocative voyage of life, the golden years emerge as a time to relish the fruits of decades of labor, to bask in the

Unlock the Secret to Sweet Dreams: 10 Ways of Enhancing Sleep Quality as You Age

Share on facebook Facebook Share on twitter Twitter Share on linkedin LinkedIn Share on pinterest Pinterest Share on telegram Telegram Share on whatsapp WhatsApp Share

Building Bridges, Not Walls: 10 Methods of Mastering the Art of Cultivating Social Connections in the Golden Years

Share on facebook Facebook Share on twitter Twitter Share on linkedin LinkedIn Share on telegram Telegram Share on whatsapp WhatsApp Share on email Email Share

Navigating the Golden Years: 10 Ways to Achieve Emotional Wellness and Conquering Loneliness

Share on facebook Facebook Share on twitter Twitter Share on linkedin LinkedIn Share on pinterest Pinterest Share on telegram Telegram Share on whatsapp WhatsApp Share

Stay Brainy in Your Golden Years: 10 Fun Activities to Keep Your Mind Sharp and Engaged!

Hello, brain buffs! Aging might be inevitable, but letting our minds turn to mush? No way, José! Time to boot up those brain cells and