Forex Trading

Forex trading has become increasingly popular in Malaysia, with more than 4.7 million people claiming to actively participate in the market. This makes Malaysia one of the leading countries in terms of Forex trading. In fact, one out of six adult Malaysians invests in Forex, indicating a growing interest in the financial markets.

Despite the popularity of Forex trading, Malaysia has strict laws and regulations in place to ensure the safety of investors. One of these laws is the Exchange Control Act of 1953, which governs all foreign exchange transactions in Malaysia.

Under this act, non-residents are allowed to invest in Malaysia and purchase ringgit assets such as land, property, and securities. There are no restrictions on transferring abroad in foreign currency, all profits, returns, and divestment proceeds from their investments in Malaysia.

In addition to this, Malaysian traders invest over 76 million USD per month in Forex, making Malaysia one of the four most promising countries for development in this market. This shows that the country has a large pool of investors who are keen to take advantage of the potential gains in the Forex market.

However, it is important to note that Forex trading can be risky, and investors must exercise caution and use a reliable broker. The Malaysian government has also taken steps to regulate the Forex market and ensure that investors are protected from fraudulent activities.

Overall, Forex trading in Malaysia is a growing industry with great potential for investors. With proper education, a solid trading plan, and careful risk management, investors can take advantage of the opportunities available in this market.

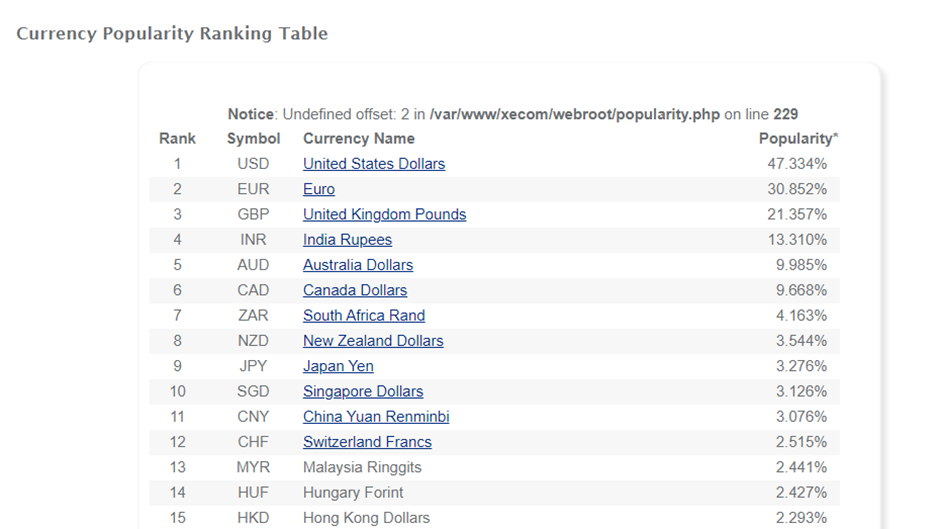

Currency popularity ranking refers to the ranking of currencies that are commonly traded in the Forex market. Malaysia is known for its active participation in the Forex market, and as such, the country’s currency popularity ranking remains high. The Malaysian ringgit (MYR) is among the top 20 most traded currencies in the world, and it is the fourth most popular currency in Southeast Asia, behind the Thai baht, Singapore dollar, and Philippine peso.

The high ranking of the Malaysian ringgit in the Forex market is due to several factors. Firstly, the Malaysian economy is one of the most stable and developed in Southeast Asia, with a strong financial sector and a diversified economy. This makes the ringgit an attractive currency for investors looking to diversify their portfolios.

Secondly, Malaysia has a well-established regulatory framework for the Forex market, which ensures that investors are protected from fraudulent activities. This has helped to build confidence among investors, making the ringgit a popular currency for trading.

Finally, the Malaysian government has taken steps to promote the use of the ringgit in international trade, which has helped to increase the demand for the currency. For example, Malaysia has established currency swap agreements with several countries, including China, South Korea, and Japan, which allows for the exchange of currencies between the countries involved.

Overall, the high ranking of the Malaysian ringgit in the Forex market is a reflection of the country’s strong economy, well-regulated financial sector, and government policies that promote the use of the currency in international trade. This makes Malaysia an attractive destination for Forex traders looking to invest in a stable and growing market.

Forex income is taxable in Malaysia, which means that traders must pay income tax on the profits they make from Forex trading. However, Forex capital gains are exempted from tax, which means that traders who make capital gains from Forex trading do not need to pay taxes on those gains. It is important to note that this exemption applies only to capital gains and not to income from Forex trading. Traders who trade with a swap-free Islamic account are also exempted from tax if they are not earning any income from their trading.

The taxation policy for Forex trading in Malaysia is a reflection of the country’s efforts to promote Forex trading as a legitimate and regulated industry. It also ensures that traders pay their fair share of taxes, which helps to support the country’s economy and development.

However, the lack of customer support in the Malay language is a challenge for traders who want to trade using Malay. Only a few brokers currently offer customer support in Malay or websites translated into that language, which can be inconvenient for some traders. This is an area that needs improvement to make Forex trading more accessible to Malaysians who prefer to trade in their native language.

Overall, Forex trading in Malaysia is a growing industry with potential for traders to earn profits while adhering to the country’s regulations and taxation policies. With the right broker and trading strategy, Forex trading can be a lucrative venture for those who are willing to put in the effort to learn and understand the market.

Forex trading in Malaysia requires traders to acquire considerable market knowledge and develop a proper trading plan. This is because the Forex market is highly volatile and unpredictable, and without the proper knowledge and strategies, traders can lose significant amounts of money. Traders need to have a deep understanding of market trends, economic indicators, and technical analysis to make informed trading decisions.

In addition to knowledge, traders must also have enough discipline to keep to their trading plan. This is because emotions such as fear and greed can cloud judgement and lead to impulsive trading decisions. Successful traders must remain disciplined and stick to their strategies even when the market conditions are unfavorable.

Another requirement for Forex trading in Malaysia is having enough risk capital to fund the chosen strategy adequately. Trading in the Forex market involves risks, and traders must be prepared to accept losses. Having enough risk capital ensures that traders can absorb losses without being forced to exit their trades prematurely.

Finally, traders must also have enough free time to implement their strategies. Forex trading requires traders to monitor the markets constantly, which means that they must be available to execute trades when opportunities arise. This can be challenging for those with busy schedules, making Forex trading a time-consuming activity.

In conclusion, the threshold for Forex trading in Malaysia is higher compared to other investment options. Traders must have a deep understanding of the market, a proper trading plan, enough discipline, enough risk capital, and enough free time to implement their strategies. With the right approach, however, Forex trading can be a profitable investment opportunity for Malaysians looking to diversify their portfolios.

Cryptocurrency Trading

The adoption of cryptocurrencies in Malaysia has grown significantly over the past year. In 2021 alone, about RM21 billion in digital assets were traded in the country, indicating a growing interest in this emerging asset class. According to a recent survey, 18% of Malaysian adults currently own cryptocurrencies, which is ahead of the global ownership average.

However, it is important to note that cryptocurrencies are not legal tender in Malaysia. This means that while they are not illegal, they are not recognized as a form of payment or currency by the government. This lack of legal status creates some uncertainty for investors and traders in the cryptocurrency market.

Cryptocurrency exchanges, on the other hand, are legal in Malaysia but must register with the Malaysian Securities Commission. The registration process includes demonstrating the fitness of senior management employees and the ability to manage the AML/CFT risks associated with their business. This helps to ensure that exchanges operating in Malaysia are reputable and comply with local regulations.

The Malaysian government has taken a cautious approach to cryptocurrency regulation, and the lack of clear guidelines has created some confusion among traders and investors. However, the government has also recognized the potential of blockchain technology, and efforts are being made to explore its use cases in various industries.

In conclusion, while cryptocurrency trading is legal in Malaysia, it is important for traders and investors to understand the legal and regulatory landscape before investing in this asset class. As the adoption of cryptocurrencies continues to grow in Malaysia, it is likely that regulations will continue to evolve to provide more clarity and security for investors.

In Malaysia, only four exchanges are currently licensed and regulated by the Securities Commission. These exchanges have independent trustees to entrust their investors’ funds, providing an added layer of security for investors. This also means that if something were to go wrong with the platform, the Securities Commission can take steps to protect investors’ funds to some extent.

Individuals in Malaysia are not subject to crypto tax, as the country does not consider cryptocurrency as a capital asset. However, it’s important to note that cryptocurrency is only tax-free if it’s not a repetitive or regular form of income. This means that if someone handles their crypto like a day trader, the revenue generated from it will still be taxed. For businesses, Malaysia imposes income tax on any profits generated through cryptocurrency trading.

The Malaysian government has taken a cautious approach to cryptocurrency regulation. They have yet to establish clear guidelines for the industry, creating uncertainty for investors and traders. However, the government has recognized the potential of blockchain technology, and efforts are being made to explore its use cases in various industries.

Despite the lack of clear guidelines, the adoption of cryptocurrencies has grown significantly in Malaysia. Many individuals and businesses have started to embrace digital assets as an investment opportunity, and more exchanges are expected to emerge in the coming years. It is important for traders and investors to stay informed about the latest developments in the industry and to be aware of the risks associated with trading cryptocurrencies.

In conclusion, while Malaysia is still in the early stages of regulating the cryptocurrency industry, the government is taking steps to ensure that the industry operates in a safe and secure manner. With more regulation expected to be introduced in the future, the country is likely to become an important player in the global cryptocurrency market.

Malaysians who own cryptocurrency can use it to purchase goods and services from a small but growing number of merchants. Some of the businesses that accept cryptocurrency in Malaysia include BolehVPN, ExpressVPN, Goobat, Jijah’s Nasi Kerabu, Mahkota Briyani, Rawlulu, and Vape Club International. While the number of merchants accepting cryptocurrency is still limited, it is expected to grow as more businesses become aware of the benefits of accepting digital currencies.

However, it’s important to note that cryptocurrency prices are extremely volatile. For example, the price of a single Bitcoin in March 2022 has fluctuated widely. As cryptocurrency prices are not stable, individuals who use their crypto to purchase goods or services may experience significant price changes in a short period of time.

Another consideration when using cryptocurrency is that payments are not immediate. Transactions can take up to three days to be reflected on the blockchain ledger, and during this time, the currency value could have changed drastically. It is important to keep this in mind when using cryptocurrency for transactions, as the price volatility can affect the overall value of the transaction.

In conclusion, while the number of merchants accepting cryptocurrency in Malaysia is still relatively small, the industry is expected to grow in the coming years. However, it’s important for individuals to keep in mind the volatility of cryptocurrency prices and the potential delays in transactions when using digital currencies for purchases. As the cryptocurrency industry continues to evolve and regulations are introduced, it is likely that more businesses will start to accept digital currencies as a form of payment.

References

https://hr.asia/media-outreach/every-sixth-malaysian-came-across-forex-before-and-they-are-likely-to-become-regular-traders-octafx-reports-2/

https://www.nst.com.my/business/2022/05/796525/malaysias-crypto-scene-booming-what-are-risks

https://complyadvantage.com/insights/malaysia-cryptocurrency-regulation-is-it-legal/

https://www.xe.com/popularity.php

https://www.asktraders.com/learn-to-trade/forex-trading/forex-trading-malaysia-legal/

https://www.bigpayme.com/post/buying-crypto-in-malaysia#viewer-3j5nh

https://getgoldenvisa.com/crypto-tax-free-countries#ftoc-malaysia

https://www.benzinga.com/money/forex-trading-in-malaysia

https://www.imoney.my/articles/what-to-buy-with-cryptocurrency

https://www.benzinga.com/money/forex-trading-in-malaysia

A Pillar of Strength in Golden Years: 10 Paths on How Regular Screenings Uphold Your Health

In the evocative voyage of life, the golden years emerge as a time to relish the fruits of decades of labor, to bask in the

Unlock the Secret to Sweet Dreams: 10 Ways of Enhancing Sleep Quality as You Age

Share on facebook Facebook Share on twitter Twitter Share on linkedin LinkedIn Share on pinterest Pinterest Share on telegram Telegram Share on whatsapp WhatsApp Share

Building Bridges, Not Walls: 10 Methods of Mastering the Art of Cultivating Social Connections in the Golden Years

Share on facebook Facebook Share on twitter Twitter Share on linkedin LinkedIn Share on telegram Telegram Share on whatsapp WhatsApp Share on email Email Share

Navigating the Golden Years: 10 Ways to Achieve Emotional Wellness and Conquering Loneliness

Share on facebook Facebook Share on twitter Twitter Share on linkedin LinkedIn Share on pinterest Pinterest Share on telegram Telegram Share on whatsapp WhatsApp Share

Stay Brainy in Your Golden Years: 10 Fun Activities to Keep Your Mind Sharp and Engaged!

Hello, brain buffs! Aging might be inevitable, but letting our minds turn to mush? No way, José! Time to boot up those brain cells and

10 Effective Exercise Routines for Older Adults: Low-Impact Fitness Options

Of course, maintaining physical health is crucial at any age, but especially so as we grow older. Here are ten gentle, effective, and friendly exercise