According to Bloomberg research, over the last 90 days, 1.9 million NFTs were sold. Still, three-quarters of them have yet to see another transaction due to the inability to find a buyer. Imagine buying a stock and not being able to sell it – it’s essentially worthless.

Why is NFT Crushing?

No unified blockchain for NFTs

NFTs or non-fungible tokens have taken the digital world by storm in recent years. These digital assets represent ownership of a unique item or piece of content, such as artwork, music, or video. While some argue that NFTs have the potential to revolutionize the art world by creating new revenue streams for artists and changing the way we think about ownership, there are several reasons why the current NFT boom may be unsustainable.

Firstly, there is no unified blockchain for NFTs. Tracking and managing NFTs requires a significant amount of work, and there are still legal issues that need to be resolved, such as the ownership of the pixel art if they are being traded on an exchange or platform with a centralized database. Without a unified blockchain, there is also the risk that NFTs’ value may evaporate if the next wave of more advanced technologies that supersedes crypto or blockchain is incompatible with secure NFT ownership. This could result in ownership claims becoming murky, making it difficult for investors to claim their assets.

Prices of NFTs are built based on momentum, not actual value

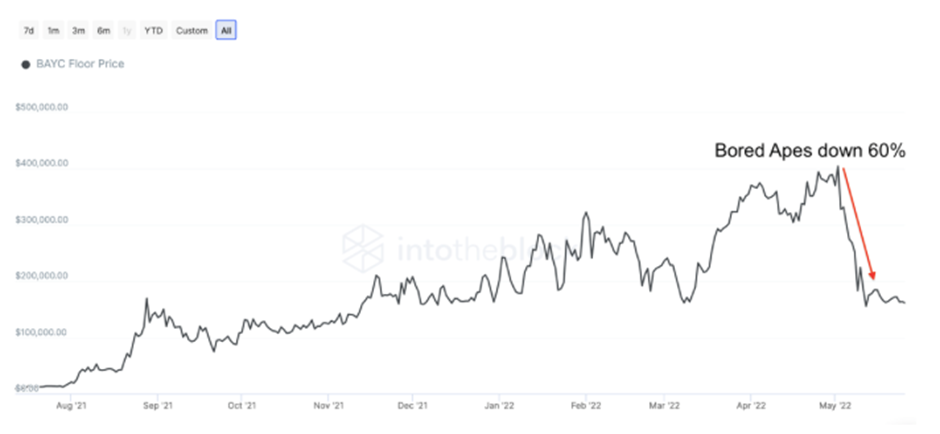

Secondly, the prices of NFTs are built based on momentum, not actual value. The hype and frenzy around NFTs have been fueled by celebrity endorsements, FOMO, and the perception that they represent a new and exciting asset class. However, this hype-driven market can be unstable and unsustainable, as anything that is built on momentum through the promotion of celebrity and FOMO can quickly die down. Additionally, prices of many NFTs were also inflated due to syndicates trading among themselves, which further added to the hype and led to artificial inflation.

Finally, there are concerns about the environmental impact of NFTs. The process of creating and trading NFTs requires significant energy consumption and contributes to carbon emissions. This has led to criticism from environmentalists and concerns about the sustainability of NFTs in the long run.

The decline of cryptocurrencies

While it’s true that NFTs have seen a recent decline in their floor prices, it’s important to note that the market for NFTs is still relatively new and volatile. The reasons for this decline are complex and multifaceted.

One reason for the decline in the prices of NFTs is the overall decline of cryptocurrencies. Cryptocurrencies and NFTs are closely tied together, as NFTs are typically bought and sold using cryptocurrencies like Ethereum. As the prices of cryptocurrencies have declined, it has become more difficult for investors to buy and sell NFTs.

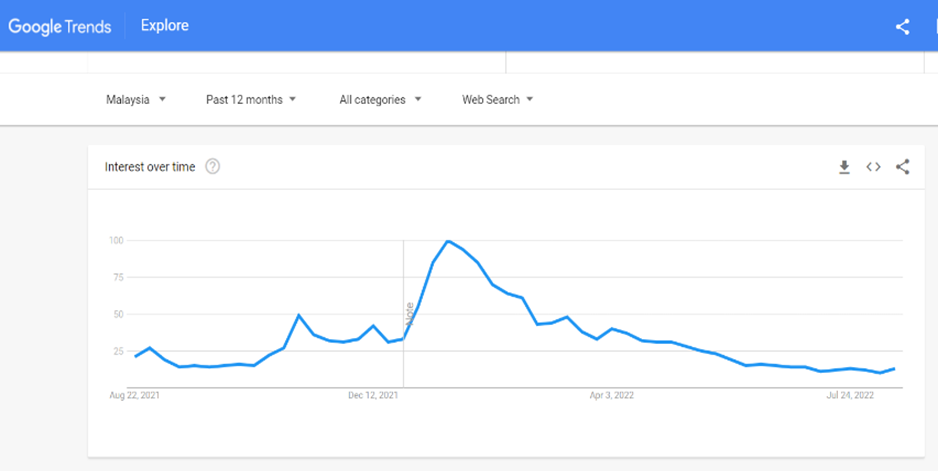

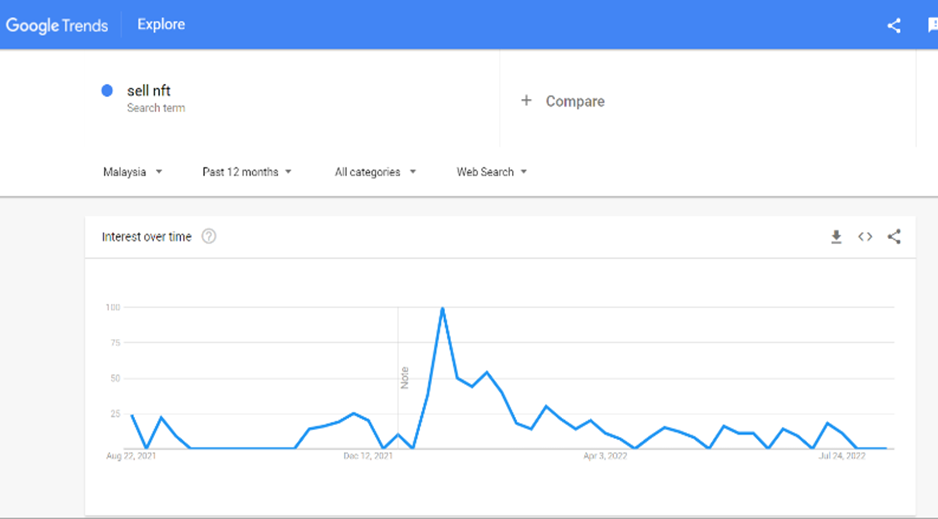

Declining investor interest in NFTs

Another reason for the decline in investor interest in NFTs is the problem of infinite supply. NFTs offer ownership of a digital asset, but not the right to prevent others from using its digital copies. Because the blockchain cannot store the underlying digital asset, someone buying an NFT is buying a link to the digital artwork, not the artwork itself. This means that the original digital asset can be copied and distributed freely, making the NFT less valuable.

In addition to these factors, the NFT market is also subject to hype cycles and speculation. Many NFT projects have seen huge price increases based on hype and celebrity endorsements, only to see their prices crash back down once the hype dies down.

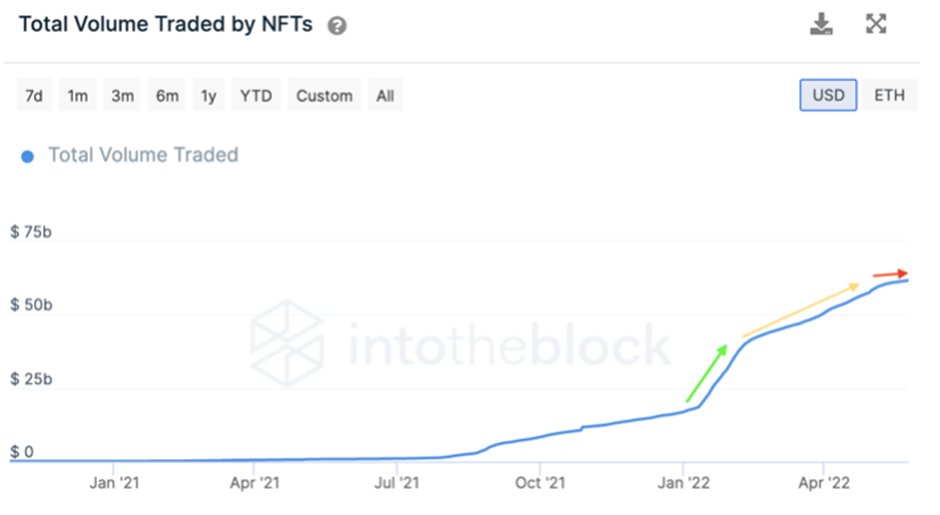

The crash in the NFT prices eventually led to a dramatic downturn in trading volumes. The NFT market could not carry the momentum earlier in the year and plummeted starting in April.

In January alone, the transaction volume was above $16 billion, but it crashed down to just $4 billion (so far) in May. TechCrunch says Coinbase’s NFT marketplace has disappointed, trading under a million dollars worth of NFTs and less than 2,000 users.

References

https://www.gfinityesports.com/cryptocurrency/shiba-eternity-popularity-servers/

https://www.project-syndicate.org/commentary/reasons-why-nft-market-will-collapse-by-patrick-reinmoeller-and-karl-schmedders-2022-01

“If we enter a real recession, NFTs are going to be the first to go,” he said. “People aren’t going to value art, especially in such a new age of digital art, when there are many more problems in the world.”

DAVID HSIAO, Chief Executive of The Crypto Magazine, Block Journal

A Pillar of Strength in Golden Years: 10 Paths on How Regular Screenings Uphold Your Health

In the evocative voyage of life, the golden years emerge as a time to relish the fruits of decades of labor, to bask in the

Unlock the Secret to Sweet Dreams: 10 Ways of Enhancing Sleep Quality as You Age

Share on facebook Facebook Share on twitter Twitter Share on linkedin LinkedIn Share on pinterest Pinterest Share on telegram Telegram Share on whatsapp WhatsApp Share

Building Bridges, Not Walls: 10 Methods of Mastering the Art of Cultivating Social Connections in the Golden Years

Share on facebook Facebook Share on twitter Twitter Share on linkedin LinkedIn Share on telegram Telegram Share on whatsapp WhatsApp Share on email Email Share

Navigating the Golden Years: 10 Ways to Achieve Emotional Wellness and Conquering Loneliness

Share on facebook Facebook Share on twitter Twitter Share on linkedin LinkedIn Share on pinterest Pinterest Share on telegram Telegram Share on whatsapp WhatsApp Share

Stay Brainy in Your Golden Years: 10 Fun Activities to Keep Your Mind Sharp and Engaged!

Hello, brain buffs! Aging might be inevitable, but letting our minds turn to mush? No way, José! Time to boot up those brain cells and

10 Effective Exercise Routines for Older Adults: Low-Impact Fitness Options

Of course, maintaining physical health is crucial at any age, but especially so as we grow older. Here are ten gentle, effective, and friendly exercise