Share on facebook

Facebook

Share on twitter

Twitter

Share on linkedin

LinkedIn

Share on pinterest

Pinterest

Share on telegram

Telegram

Share on whatsapp

WhatsApp

Share on email

Email

Share on print

Print

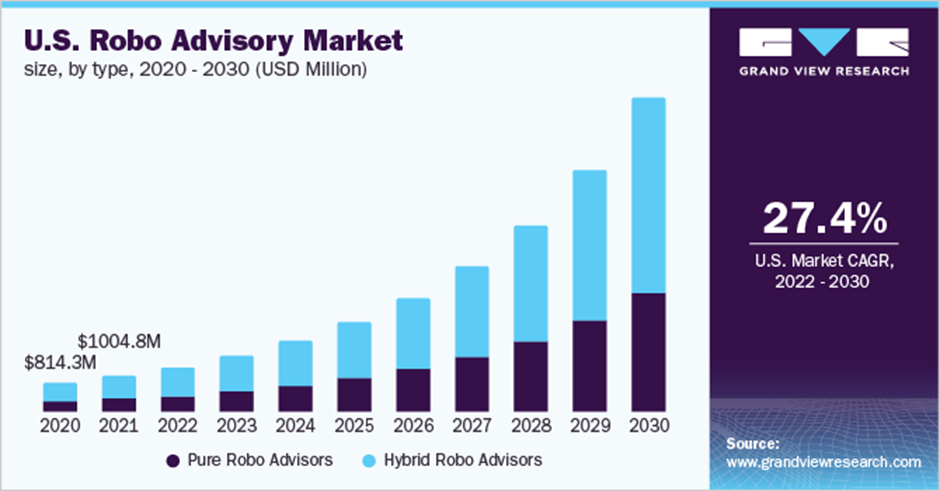

Robo-advisors are digital platforms that use algorithms to provide automated investment management services. They have been growing in popularity in recent years due to their low fees, convenience, and accessibility to individual investors. According to a report by Grand View Research, the global robo-advisory market was valued at USD 4.13 billion in 2021 and is expected to grow at a compound annual growth rate (CAGR) of 29.7% from 2022 to 2030. This article explores the reasons behind the growth of robo-advisors and the features that a good robo-advisor should have.

Reasons for the Growth of Robo-Advisors

Digitilization of financial sector

The widespread digitalization of the financial sector is one of the primary reasons for the growth of robo-advisors. The use of technology in financial services has enabled robo-advisors to offer users tech-enabled analytics for investment consultations. Additionally, there has been a rapid shift from traditional investment services to robo-advisory investment services. Investment platforms now offer robo-advisors as new digital financial advisors over traditional investment services, enabling the scope of expansion for robo-advisors.

Low fees

Another factor contributing to the growth of robo-advisors is their low fees. Unlike traditional financial advisors who charge high fees, robo-advisors charge lower fees due to the lower operating costs associated with their use of algorithms to provide automated investment management services. This lower fee structure makes it possible for individual investors to access professional investment management services that were previously only available to high net worth individuals.

Features of a Good Robo-Advisor

Comprehensive Profile Survey

A good robo-advisor should have a comprehensive profile survey that covers psychographic and demographic questions to lead to a model portfolio. The survey should be able to understand and predict investor preferences, risks, and goals. A simplistic robo-advisor will cover queries on gender, income, liabilities, risk portfolio, and current asset allocation. An extensive robo-advisor will look for more in-depth information like financial transactions to understand economic behavior or the investor. This will help to create an investment portfolio that is tailored to the investor’s needs and goals.

Clear Revenue Stream

Every robo-advisor has a different revenue stream. Some earn income through a commission from the product manufacturer; others charge an advisory fee from the investors. It is important to choose a robo-advisor that has a clear revenue stream. Currently, the majority of the best robo-advisory firms have either eliminated or are in the process of removing commission fees on everyday stock transactions like Vanguard. They only charge a small fee on certain types of securities transactions. The exclusion of trading fees also became an essential feature of a good robo-advisor because it only charges customers based on assets under management, not on a per-transaction basis. Thus, investors can trust that their robo-advisor is working in their favor.

Availability of Tax-Loss Harvesting

Robo-advisor tax-loss harvesting is the automated selling of securities in a portfolio to deliberately incur losses to offset the amount of capital gains tax. The program seeks to help investors reduce the cost of capital gain taxes and preserve the value of the investor’s portfolio. For example, an investor that has a capital gain of $15,000 and falls in the highest tax bracket will have to pay 20%, or $3,000, to the government. But if they sell XYZ security for a loss of $7,000, their net capital gain for tax purposes will be $15,000 – $7,000 = $8,000, meaning that they will have to pay only $1,600 in capital gains tax.

| Robo Advisor | Accounts Eligible for Tax-Loss Harvesting |

| Wealthfront | Any taxable accounts |

| Schwab Intelligent Portfolios | Taxable accounts of clients with $50000+ in invested assets which have enrolled for the service |

| Betterment | Any taxable accounts |

| Personal Capital | Taxable accounts of clients with &100000+ in invested assets |

| SigFig | Any taxable accounts of clients who sign up for a managed account |

| Vanguard | No tax-loss harvesting feature |

| SoFi Automated Investing | No tax-loss harvesting feature |

User-friendly platform

Robo advisors are supposed to make investing more accessible and user-friendly for the average person. Therefore, a good robo advisor should have an intuitive and user-friendly platform. The platform should be easy to navigate, and investors should be able to access their portfolio and investment options easily.

A good robo advisor should also provide a mobile app for investors to monitor their portfolios and make transactions on-the-go. Some robo advisors also offer educational resources and investment tools to help investors make informed decisions.

Excellent customer service

Finally, a good robo advisor should have excellent customer service. The platform should have multiple channels for investors to contact support, such as email, phone, and live chat. Investors should also have access to a dedicated account manager or financial advisor who can assist with more complex investment strategies.

In addition, a good robo advisor should have a comprehensive FAQ section and educational resources to help investors understand the platform and investment strategies.

In conclusion, robo advisors are a popular and growing trend in the financial industry, with the global robo-advisory market expected to grow at a compound annual growth rate of 29.7% from 2022 to 2030. A good robo advisor should have essential features such as a comprehensive profile survey, clear revenue stream, availability of tax-loss harvesting, customizable investment options, user-friendly platform, robust security measures, and excellent customer service.

Investors should research and compare different robo advisors to find one that best fits their investment goals and preferences. As with any investment, it is important to understand the risks and potential rewards before investing. However, with the right robo advisor, investing can become more accessible, user-friendly, and potentially more rewarding for the average person.

References

https://www.grandviewresearch.com/industry-analysis/robo-advisory-market-report

https://www.forbes.com/advisor/in/investing/what-is-a-robo-advisor-and-how-does-it-work/

https://www.forbes.com/advisor/investing/best-robo-advisors

/https://tokenist.com/investing/how-do-robo-advisors-make-money/

https://www.investopedia.com/terms/r/robo-tax-loss-harvesting.asp

https://www.investopedia.com/terms/t/taxgainlossharvesting.asp

https://moneymade.io/learn/article/best-robo-advisor-for-tax-loss-harvesting