Case Study

Elderly Man Loses RM200k in Credit Card Scam (8 March 2022)

The 83-year-old man was contacted by a “bank representative” who claimed his name was used to register a platinum credit card. Then, they asked for his online banking user ID, password and OTP. The old man followed as well and lost RM200k within minutes.

She Got a Call Saying Her Bank Records Had Been Found in A Car with Drugs (23 May 2022)

Sherri got a phone call warning that her bank records had been found in a car loaded with illegal drugs. Thus, the “Drug Enforcement Administration agent” required her to send cash to avoid trouble. Due to intense shock and panic, she did what was needed and was stolen $10 million.

Both cases are examples of telephone fraud, where scammers call their victims and trick them into revealing personal and financial information or make them transfer money. These types of scams can happen to anyone, especially vulnerable populations like the elderly. It is important to never disclose personal information or make payments over the phone, especially to unsolicited callers. It’s recommended to verify the authenticity of the caller by contacting the organization directly through a known and trusted channel, such as the phone number on the back of a bank card. If in doubt, it’s always better to err on the side of caution and not disclose any information or make any payments.

Statistics

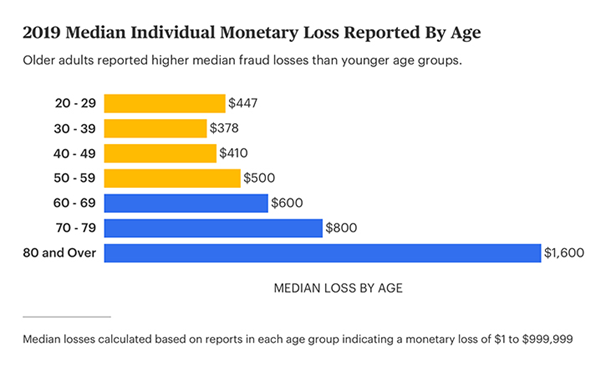

Older people are swindled out of more than $3 billion annually

More than 3.5 million older adults are victims of financial exploitation each year

(Source: consumeraffairs.com)

Why do the Elderly Fall for Scams That Seems So Obvious to Us?

Trusting | It is proven that that older adults tend to be more trusting than younger individual (Kirchhemier, 2011). Studies have shown that they are more likely to believe that people are friendly and kind. This can make them more susceptible to scams, as they may be more likely to trust someone who seems to be offering them a good deal or who appears to be trying to help them.While this trust is often admirable and a positive trait, it can also leave them vulnerable to exploitation. As such, it is important for older adults to be aware of the risks of fraud and to take precautions to protect themselves. This can include being cautious about giving out personal information and verifying the authenticity of anyone who contacts them with an offer that seems too good to be true. | |

Loneliness | Loneliness is a significant factor that can make elderly people more susceptible to falling for scams that may seem obvious to others. Elderly people may not have partners, children, or peers around, which can make them more isolated and vulnerable. Scammers can prey on this vulnerability by developing relationships with the elderly person, which can make them more trusting and willing to part with their money.When strangers approach them, elderly people may have a stronger desire to initiate a conversation as a way to combat loneliness. Scammers can use this desire for companionship and social interaction to their advantage, developing a rapport with the elderly person and building trust.Moreover, cognitive decline that is commonly associated with aging can also impact the elderly’s ability to recognize scams. Scammers use psychological tactics such as urgency, fear, or creating a sense of obligation to make the victim act quickly and without proper consideration. These tactics can be particularly effective against elderly individuals who may have difficulty recognizing and responding to them. | |

Financial Insecurity | Limited income: Many elderly individuals are on a fixed income, such as Social Security or a pension, which may not provide them with enough money to cover all of their expenses. As a result, they may be more susceptible to scams that promise quick and easy ways to make money or save money. | |

Illness | Illnesses such as Alzheimer’s disease or other forms of dementia can significantly impair an elderly person’s judgment and decision-making abilities. These conditions can make individuals more susceptible to scams and financial exploitation, as they may not be able to fully understand the implications of their actions or recognize when they are being taken advantage of.In addition to cognitive decline, many medications commonly prescribed to elderly individuals can also impair judgment and increase vulnerability to scams. For example, some pain medications, sedatives, and antidepressants can cause confusion, drowsiness, and disorientation. This can make it difficult for an individual to think clearly or make informed decisions, leaving them more susceptible to financial scams and exploitation.To mitigate the risk of financial exploitation for individuals with cognitive impairments, it is important to provide appropriate supervision and support. This can include regular check-ins from family members, caregivers, or other trusted individuals who can help monitor financial transactions and ensure that the person is not being taken advantage of. It may also be helpful to limit the person’s access to financial accounts and resources, depending on the severity of their cognitive impairment.If you suspect that a loved one is being taken advantage of financially, it is important to seek help and report the situation to local authorities or other relevant organizations. This can help protect the individual from further exploitation and may also prevent others from falling victim to the same scam. | |

Fear of missing out |

| |

Lack of IT knowledge | Lack of IT knowledge is another factor that can make elderly individuals more vulnerable to scams. Many scams involve computer or internet-based fraud, and elderly individuals who are less familiar with technology may be more likely to fall for these scams. Scammers may provide a phone number to call for “technical support,” which can lead to remote access to the victim’s computer and sensitive information. |

A Pillar of Strength in Golden Years: 10 Paths on How Regular Screenings Uphold Your Health

In the evocative voyage of life, the golden years emerge as a time to relish the fruits of decades of labor, to bask in the

Unlock the Secret to Sweet Dreams: 10 Ways of Enhancing Sleep Quality as You Age

Share on facebook Facebook Share on twitter Twitter Share on linkedin LinkedIn Share on pinterest Pinterest Share on telegram Telegram Share on whatsapp WhatsApp Share

Building Bridges, Not Walls: 10 Methods of Mastering the Art of Cultivating Social Connections in the Golden Years

Share on facebook Facebook Share on twitter Twitter Share on linkedin LinkedIn Share on telegram Telegram Share on whatsapp WhatsApp Share on email Email Share

Navigating the Golden Years: 10 Ways to Achieve Emotional Wellness and Conquering Loneliness

Share on facebook Facebook Share on twitter Twitter Share on linkedin LinkedIn Share on pinterest Pinterest Share on telegram Telegram Share on whatsapp WhatsApp Share

Stay Brainy in Your Golden Years: 10 Fun Activities to Keep Your Mind Sharp and Engaged!

Hello, brain buffs! Aging might be inevitable, but letting our minds turn to mush? No way, José! Time to boot up those brain cells and

10 Effective Exercise Routines for Older Adults: Low-Impact Fitness Options

Of course, maintaining physical health is crucial at any age, but especially so as we grow older. Here are ten gentle, effective, and friendly exercise