Does life insurance matter? Will senior citizens find it worthwhile? Life insurance, in my opinion, is crucial for everyone, but it’s more critical for seniors since it guards against the uncertainty that could happen to them at any time. It offers complete defence against the possibility of death or disability. You’ll feel more at ease if you have life insurance. Life is unpredictable, and life insurance can provide seniors’ families with financial support after they pass away.

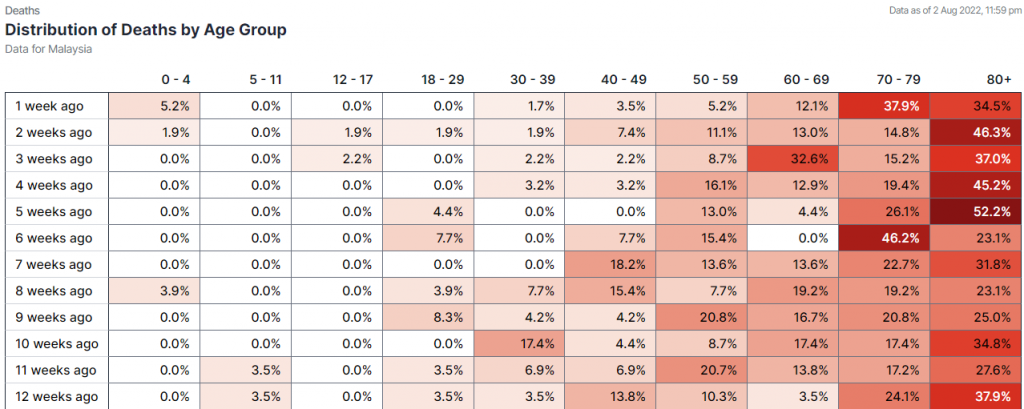

According to the Life Insurance Association of Malaysia, the current pandemic era has raised Malaysians’ awareness of the importance of having insurance protection for themselves and their loved ones in the event of death, illness, or disability. In 2020, when COVID-19 strikes Malaysia, seniors aged 60 and older made up a significant percentage of the mortality. According to COVIDNOW Malaysia, seniors continue to account for a substantial portion of mortality due to their weakened immune systems and the fact that most seniors develop at least one comorbidity as they age. So, seniors must acquire life insurance to be prepared for death.

Life insurance: Worth for seniors?

What is Life Insurance?

WHY Worth?

Cover funeral cost

Everyone must experience birth and death, an inevitable component of this ecosystem. Everyone will still experience death when they are old despite no pandemic. However, the pandemic will fasten the death process when senior citizens get Covid-19. This can be proven by the World Health Organization (WHO), which shows that older persons have a higher risk of having severe illness from diseases because of physiologic changes brought on by ageing and potential underlying medical disorders. I believe that many senior citizens worry that when they pass, their families may not have enough money to pay for their funeral, and they do not want to put an additional financial burden on them. Also, paying for a funeral can be costly, and obtaining the necessary funds to pay for it can be burdensome, especially during a challenging and unexpected time. They might not have time to withdraw a large sum of money quickly. Therefore, life insurance is a means for people to plan because it may be used to pay for funeral services when families need to arrange a funeral for seniors who suddenly pass away. Therefore, funeral costs will not burden their children when they die.

Financial support for the beneficiary

Financial security for you and your family is the primary goal of life insurance. When a policyholder dies, their beneficiaries receive cash from life insurance. This money can be used for anything, including living expenses, college tuition, mortgage payments, and even regular bills and fees. I know that all parents desire to have their kids cared for, even when absent. Thanks to life insurance, your loved ones won’t suffer financially if you pass away. However, there is no way to replace a loved one; planning with life insurance aids in meeting the family’s financial demands. As a result, this benefit safeguards every family’s financial stability so they won’t unexpectedly lose support if their way of life depends on the policyholder’s income.

Another Important Insurance?

Apart from life insurance, health insurance is also another essential insurance for senior citizens. In essence, health insurance provides coverage for medical care during their golden years, including doctor visits, prescriptions, hospitalisation, and surgeries. We all know that our immune systems weaken as we age, and we become sick and end up in the hospital more frequently. Therefore, this explains why many older adults visit hospitals often. Some people can’t even afford the medical costs because of the pricey medical bill. The medical expenses can rise to excessive levels and drain your savings suddenly. Additionally, the circumstances and treatment expenses taken together may cause you a lot of suffering. Health insurance can therefore be helpful where seniors could be shielded from unforeseen and expensive medical costs.